Unlock the power of IUL to build long-term wealth

Protect Your Future & Grow Wealth Tax-Free with IUL Insurance

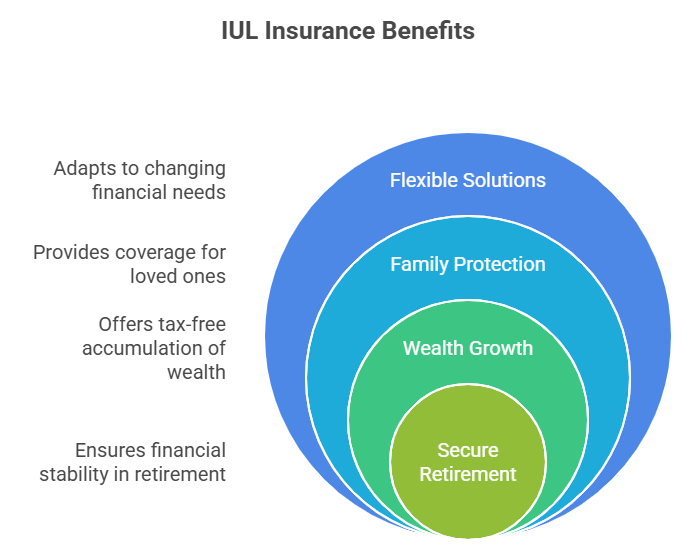

Protect your loved ones and secure your retirement,even if the market crashes. Discover how Indexed Universal Life insurance can provide tax-free growth, permanent life coverage, and flexible financial solutions for your family's future. Souleymane Coulibaly, a licensed IUL insurance agent with TransAmerica, is here to guide you.

ABOUT US

About Souleymane Coulibaly: Your Trusted IUL Insurance Agent

Hi, I’m Souleymane Coulibaly, a dedicated and licensed IUL Insurance Agent specializing in Indexed Universal Life Insurance and comprehensive retirement planning. With years of experience, I empower individuals and families to achieve financial freedom by leveraging advanced life insurance strategies. My mission is to educate and serve, helping you build tax-free retirement income, protect your loved ones with permanent life insurance, and grow cash value with market-linked returns, all while securing a lasting legacy for future generations. I am committed to providing personalized guidance and honest, respectful support tailored to your unique financial goals.

Ready to Secure Your Financial Future?

Book a free, no-obligation consultation to explore how IUL can benefit you.

Why choose us

Licensed IUL Specialist

Expert Guidance & Personalized Planning

Benefit from years of experience and in-depth knowledge of Indexed Universal Life insurance strategies, tailored to your unique financial goals.

Learn Before You Commit

Education-First Approach

I prioritize educating you on the intricacies of IUL, ensuring you understand every aspect before making informed decisions about your financial future.

Unwavering Support & Trust

Honest & Transparent Service

Experience a partnership built on trust, honesty, and a genuine commitment to your financial well-being, with continuous support every step of the way.

Frequently asked questions

Yes, IUL policies are designed with built-in protections. While the cash value growth is linked to market indexes, it typically includes a floor (often 0%), meaning you won't lose money due to market downturns. This provides a balance of growth potential and security.

IUL combines a death benefit with a cash value component that grows based on a market index, offering tax-free growth and access to funds. Unlike traditional life insurance, it has a flexible premium and cash value growth. Unlike a 401(k), IUL offers tax-free withdrawals in retirement and protection against market losses.

Absolutely. One of the key benefits of IUL is the ability to access your accumulated cash value through loans or withdrawals. These can be used for various needs, such as retirement income, education expenses, or unexpected emergencies, often on a tax-advantaged basis.

IUL policies offer flexibility. If you stop paying premiums, the policy can continue to stay in force as long as there is sufficient cash value to cover the policy charges. However, it's important to manage your policy to ensure it aligns with your long-term financial goals.

The ideal amount of IUL coverage depends on your individual financial situation, including your income, debts, family needs, and long-term goals. During our consultation, we'll assess these factors to determine the optimal coverage that provides comprehensive protection and wealth accumulation for you and your loved ones.

Contact us

Ready to take control of your financial future? Reach out to Souleymane directly.

2701 East TowerDr

Cincinnati, OH

45238, USA.

Protect Your Future & Grow Wealth Tax-Free with IUL Insurance.

Get a free Quote Today

*We won't spam you, we promise!

©WealthGuard Insights 2025- All Rights Reserved | Designed by Ahsan Works